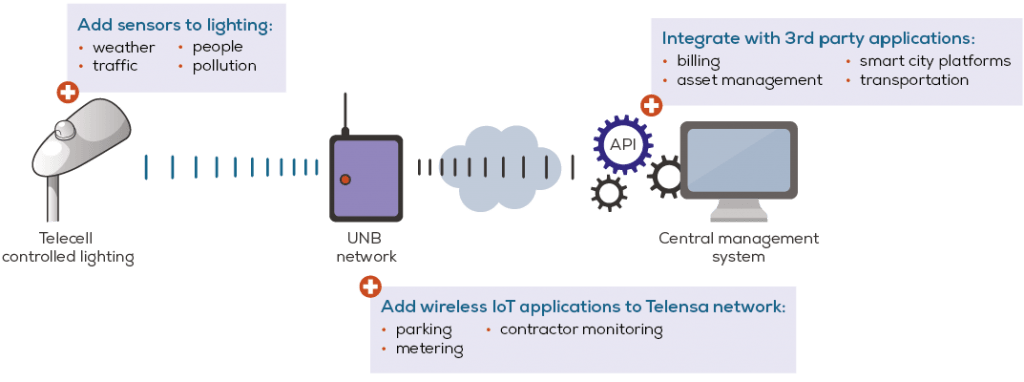

As IoT applications penetrate the market the competition between different LPWA options has grown fiercer, especially between the better known solutions like LTE-M, NB-IoT, Sigfox and LoRA and their unlicensed rivals. One such rival is the British Telensa, a smart-lighting company with over 50 city and regional networks deployed in 8 countries and a project footprint covering over 1 million streetlights. Yet Telensa doesn’t only offer a lighting solution: its bi-directional radio-enabled network can serve sensors and wireless IoT applications. Called Ultra Narrow Band (UNB), Telensa’s network claims to combine what all LPWA options strive for: low cost, long range, long battery life and a 2-way communication for massive numbers of devices.

It’s not just the features that might give Telensa an edge- it’s the fact that it has a ready-to-use product and a “business-case-first” attitude. Lighting is perhaps one of the first smart applications cities adopt, mostly due to its relatively low cost and easy maintenance. Selling a lighting solution first earns vendors like Telensa customers far easier than any other LPWA option that has to prove good coverage and performance. The fact that the lights come with a free wireless IoT network makes Telensa an even more appealing option for cities wanting to become smarter.

Today over 9 million devices across 30 countries use UNB, with a brand new pilot launched in Essex and Hertfordshire County just last month. Piggy-back riding on the 250,000 Telensa streetlight deployed in the area by utilizing their UNB network the pilot will attempt to solve various daily-life struggles through gully, wind, traffic, waste and air quality monitoring. Both counties previously relied mostly on residential reports to solve such issues and now hope to improve quality life, save taxpayer money and cut on reaction time to fixing issues. Considering that big cities like Moscow and Shenzen are using Telensa’s UNB network- it seems like Essex has made a step in the right direction. Despite predictions of unlicensed solutions having a much slower growth rate, so called “niche companies” just might give bigger LPWA options a run for their money.